Analysis of Trades and Trading Tips for the Japanese Yen

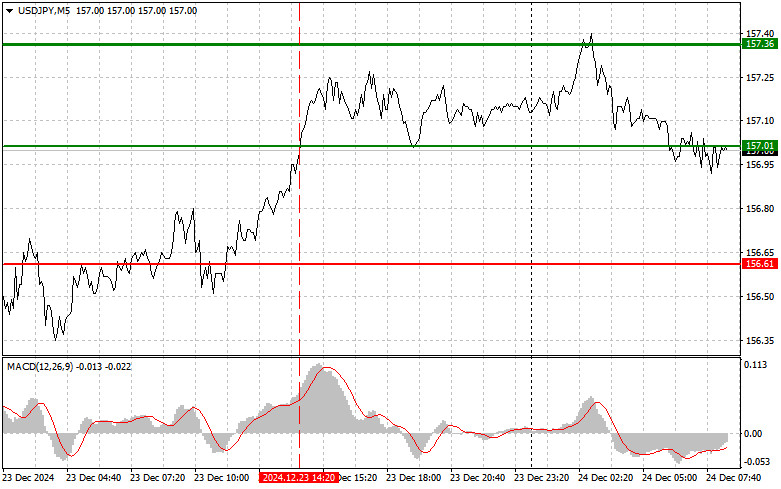

The price test at 157.01 occurred when the MACD indicator had moved significantly above the zero line, which, in my opinion, limited the upward potential of the pair. For this reason, I decided not to buy the dollar.

Despite relatively weak U.S. economic data, the USD/JPY pair continued to rise on Monday during the latter half of the day. I have consistently pointed out that this trading instrument often operates independently and reacts unpredictably to major U.S. economic indicators.

Today's data on the growth of the Bank of Japan's Core Consumer Price Index has significantly impacted financial markets and strengthened the yen. According to the latest reports, the CPI surpassed economists' expectations. These results indicate positive changes in the country's economic situation. This serves as an important signal for investors, suggesting that the fight against inflation is progressing more successfully than previously anticipated.

The recent strengthening of the yen following the data release indicates growing confidence in the Japanese economy. Investors are increasingly viewing the yen as a safe haven, especially amid economic uncertainties in other regions. This trend could enhance the purchasing power of Japanese companies operating internationally, benefiting their trade activities. However, it is important to note that a stronger yen may present challenges for Japanese exporters. A more expensive yen reduces the competitiveness of Japanese goods in international markets, which could negatively impact company profits in the long run.

The minutes from today's BOJ monetary policy meeting did not clarify the central bank's strategy for additional interest rate hikes, resulting in reduced demand for the yen.

For my intraday strategy, I will primarily focus on implementing Scenario #1 and Scenario #2.

Buy Signal

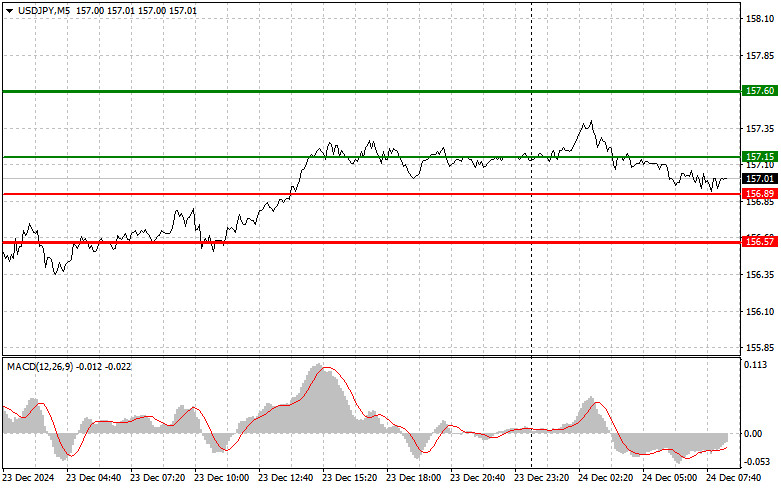

Scenario #1: I plan to buy USD/JPY today upon reaching the entry point around 157.15 (green line on the chart) with a target of rising to 157.60 (thicker green line). Around 157.60, I plan to exit purchases and open sales in the opposite direction (anticipating a movement of 30-35 pips in the opposite direction from the level). It's best to focus on further growth of the pair and buy on pullbacks. Important! Before buying, ensure that the MACD indicator is above the zero mark and beginning to rise.

Scenario #2: I also plan to buy USD/JPY today in case of two consecutive tests of the 156.89 price level when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to an upward market reversal. Growth to the opposite levels of 157.15 and 157.60 can be expected.

Sell Signal

Scenario #1: I plan to sell USD/JPY today only after the level of 156.89 (red line on the chart) is updated, leading to a quick decline in the pair. The key target for sellers will be 156.57, where I plan to exit sales and immediately open purchases in the opposite direction (anticipating a movement of 20-25 pips in the opposite direction from the level). Important! Before selling, ensure that the MACD indicator is below the zero mark and beginning to decline.

Scenario #2: I also plan to sell USD/JPY today in case of two consecutive tests of the 157.15 price level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. Declines to the opposite levels of 156.89 and 156.57 can be expected.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.