Analysis of Tuesday's Trades

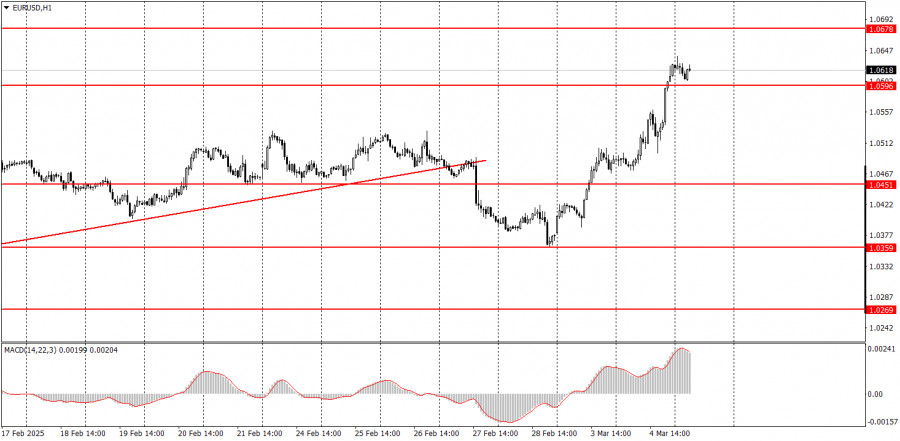

1H Chart of EUR/USD

On Tuesday, the EUR/USD currency pair continued its upward movement seemingly unaffected by recent events. During the day, only one macroeconomic report was released: the unemployment report for the Eurozone. This report could have supported the euro, as unemployment decreased from 6.3% to 6.2%, a change that surprised traders. However, we still believe that the macroeconomic context is not driving the current rise of the pair on either Monday or Tuesday. While some reports indicate growth for the euro, they are not significant enough to impact the market meaningfully.

The primary reason for the dollar's decline at the moment is U.S. President Donald Trump and his ongoing speeches. Trump continues to impose import tariffs, claiming that "almost every country in the world treats the U.S. unfairly." As a result, the markets are reacting by selling off the U.S. dollar, U.S. stocks, and even cryptocurrencies.

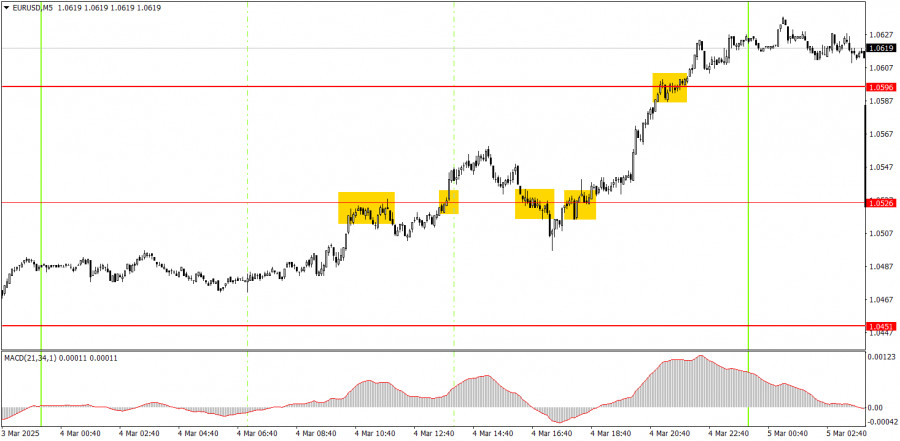

5M Chart of EUR/USD

On the 5-minute timeframe on Tuesday, several trading signals emerged, but the movements were quite chaotic. The price constantly changed direction, and there was little logic in these fluctuations. The market appears to be trading based on emotions tied to Trump's statements. These emotions are fueling the euro's growth, overshadowing important factors such as the divergence between Federal Reserve and European Central Bank rates, the strength of the U.S. economy, and the relative weakness of the European economy. As a result, most trading signals are not generating profits.

Trading Strategy for Wednesday:

The EUR/USD pair remains on a medium-term downward trend in the hourly timeframe. Since the fundamental and macroeconomic background continues to support the U.S. dollar much more than the euro, we still expect a decline. However, we might see a few more trends on the hourly chart before the main decline resumes. We are not witnessing euro growth but rather a decline in the dollar due to Donald Trump.

On Wednesday, the euro could trade in either direction. The macroeconomic background is currently meaningless, and no one knows what statements Trump might make at any given moment.

On the 5-minute timeframe, key levels to watch are 1.0156, 1.0221, 1.0269-1.0277, 1.0334-1.0359, 1.0433-1.0451, 1.0526, 1.0596, 1.0678, 1.0726-1.0733, 1.0797-1.0804, and 1.0845-1.0851. On Wednesday, service sector PMI indices will be released in the Eurozone, Germany, and the U.S., along with the ADP report in the U.S. However, reports are not as important right now as Trump's speeches.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.