The GBP/USD currency pair experienced a slight decline on Wednesday. It's important to note that we are not considering any movements following the publication of the Federal Reserve meeting results, as these can significantly impact the current technical outlook and may also be misleading. After major events like a meeting of the world's largest central bank, market participants often react emotionally. As time passes, the market may revert to its original positions. However, the signals generated during such events can lead to a series of unprofitable positions. Even if the current trend is disrupted, it can be easily restored.

For now, we are analyzing the situation without factoring in the results of the Fed meeting and Powell's speech; we will discuss those tomorrow once the market stabilizes. The decline of the British currency has been ongoing for four months, which aligns with our expectations. Throughout 2024, we have cautioned that the pound sterling has been overvalued, having risen for two years without clear justification. Both fundamentals and macroeconomic indicators suggest a downward trajectory. The market has preemptively accounted for the entire cycle of the Fed's monetary policy easing while overlooking the Bank of England. As we approach the beginning of 2025, we see that the Fed has anticipated its monetary policy easing in advance, but the easing from the BoE, which has yet to commence, has largely gone unnoticed. If we set aside this factor, which remains a hypothesis yet has some basis, it appears that the Fed could lower its key interest rate twice this year, while the BoE may do so at least four times. The BoE, much like the European Central Bank, needs to address the challenge of weak economic growth. While it's possible to cope with inflation above normal levels, managing an economy that has stagnated for two years presents a far greater difficulty.

The Labor Party has come to power in the UK, and they urgently need to demonstrate to voters that they can govern more effectively than the Conservatives, who have been in charge for over 10 years. If the Labor Party, led by Keir Starmer, fails to deliver results, they risk following the same path as Liz Truss, Boris Johnson, and Theresa May in the next election. Naturally, the party aims to remain in power for an extended period, but this requires economic growth, rising living standards, and lower taxes. Currently, the Labor Party is starting its journey with plans for higher taxes and is facing a significant budget deficit, akin to the size of Nebraska, alongside an economy that has stagnated for two years. In the US, the Fed operates independently of the government, whereas, in the UK, it works more closely with the government. Therefore, it is expected that the BoE will lower interest rates, and it may do so more aggressively and swiftly than the Fed, which could lead to a further decline in the British currency.

As it stands, the pound sterling may experience a correction for a couple more weeks. A 400-pip increase on the daily timeframe appears relatively weak considering the previous significant decline. However, our long-term outlook remains unchanged: we anticipate further depreciation of the pound.

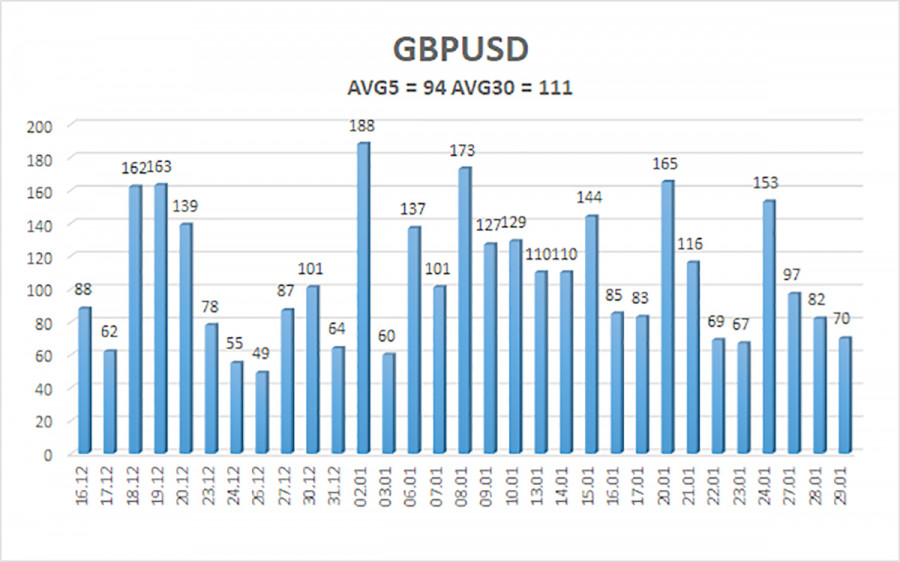

The average volatility of the GBP/USD currency pair over the last five trading days is 94 pips, considered "average" for this pair. Therefore, on Thursday, January 30, we expect the pair to move within a range defined by the levels 1.2340 and 1.2528. The higher linear regression channel remains downward, indicating a bearish trend. The CCI indicator has entered the overbought zone and formed a bearish divergence. A renewed downtrend is expected.

Key Support Levels:

- S1 – 1.2390

- S2 – 1.2329

- S3 – 1.2268

Key Resistance Levels:

- R1 – 1.2451

- R2 – 1.2512

- R3 – 1.2573

Trading Recommendations:

The GBP/USD pair continues to maintain a medium-term downtrend. Long positions remain off the table, as we believe that all bullish factors for the pound have already been priced in multiple times, and no new drivers are present. If you trade purely on technical analysis, buy positions could be considered with targets at 1.2512 and 1.2528, provided the price is above the moving average. Sell orders remain the preferred strategy, with targets at 1.2207 and 1.2146, but a confirmed break below the moving average is required.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.