Analysis of Trades and Trading Tips for the Euro

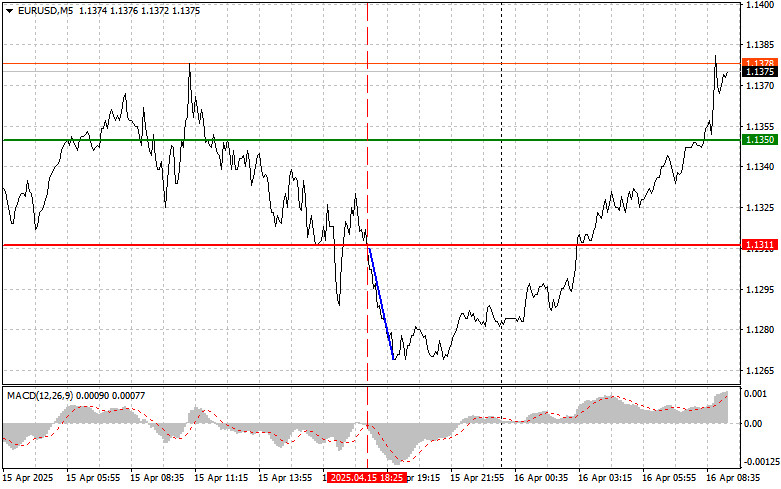

The price test at 1.1311 occurred when the MACD indicator had just started to move downward from the zero level, confirming a valid entry point for selling the euro. As a result, the pair dropped by 40 pips.

Despite the decline in the second half of the day, the single European currency showed resilience to external developments, particularly the ongoing trade tariff talks between China and the United States. A brief strengthening of the U.S. dollar triggered by these rumors did not prevent the euro from quickly regaining its lost ground. The continued uncertainty over the outlook for the U.S. economy and the risk of slower growth will likely keep supporting euro buying and pressuring the greenback.

Today, key Eurozone inflation data is due for release. These figures are crucial for assessing inflationary pressure in the region and shaping the European Central Bank's future monetary policy strategy. The Consumer Price Index (CPI) remains in focus for analysts as it reflects changes in the prices of household goods and services. The Core CPI, which excludes volatile components such as food and energy prices, will also be closely monitored by traders. Comparing the Core CPI with the headline index helps identify temporary versus persistent factors affecting inflation dynamics. The ECB's current account balance shows the difference between inflows and outflows related to trade and investment. A positive balance suggests capital inflow into the euro area, which may support the euro, whereas a negative balance can exert downward pressure on the currency.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Signal

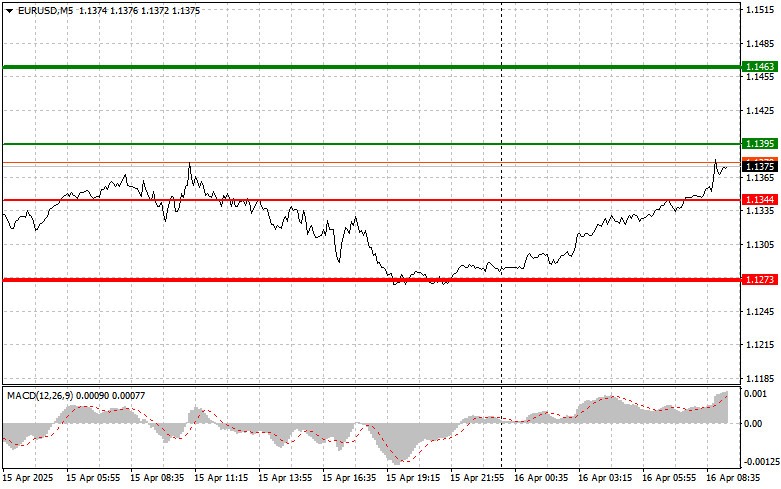

Scenario #1: Buy the euro today at the entry point around 1.1395 (green line on the chart) with a target of rising to 1.1463. At 1.1463, I plan to exit the buy and open a short position, expecting a reversal of 30–35 pips from the entry point. Following strong data, the expectation is for further upside in the first half of the day.

Important: Before buying, ensure the MACD indicator is above the zero line and starting to rise.

Scenario #2: I also plan to buy the euro if the price tests 1.1344 twice consecutively while the MACD indicator is in the oversold zone. This will limit the pair's downside potential and trigger a bullish reversal. A rise toward 1.1395 and 1.1463 can then be expected.

Sell Signal

Scenario #1: I plan to sell the euro after the price reaches the 1.1344 level (red line on the chart). The target will be 1.1273, where I'll exit the sell and enter a buy position immediately, anticipating a 20–25 pip reversal from that level. Downward pressure on the pair may resume if data comes out weak.

Important: Before selling, ensure the MACD indicator is below the zero level and beginning to decline.

Scenario #2: I also plan to sell the euro if the price tests the 1.1395 level twice in a row while the MACD indicator is in the overbought zone. This will cap the pair's upside potential and trigger a bearish reversal. A drop toward 1.1344 and 1.1273 can then be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.