An extra source of income is never a bad thing. If you are determined to make money on Forex, read the article "How to Trade Forex with $100 for any Trader"

Here you will read about methods and rules that successful forex traders use.

About Forex

When we talk about Forex, we mean a huge virtual market where foreign currencies are traded. More and more people join Forex every day. Notably, there is no single trading floor for the foreign exchange.

This global online market is operating around the clock 5 days a week. Trading sessions in different regions follow each other, creating a continuous process.

The modern forex market was established in 1971 when the US decided to abandon the so-called gold standard.

The meaning of this was that the US dollar was no longer backed by gold, while national currencies of other countries were no longer pegged to the US dollar. This created fluctuations in the currency rates.

The new system required new ways to deal with assets. This is how currency trading evolved. From now on, the currency value is determined solely by supply and demand ratio.

Forex was a necessary creation as banks, large corporations, and funds in different countries had to carry out currency exchange. With time, new market players joined Forex which led to increased trading volumes.

The daily forex trading volume has gone up from $5 billion in 1977 to more than $5 trillion today.

The main functions of the modern forex market:

- ensuring international settlements;

- serving as a link between the credit and financial markets;

- increasing diversification options for foreign exchange reserves of different countries, banks, and large multinational corporations;

- playing an important role in macroeconomy;

- creating conditions for profit-making thanks to constant fluctuations of exchange rates.

Initially, Forex was meant only for large financial institutions but later retail traders started to join it. For them, Forex is a means of generating their own profit.

Traders are attracted by the opportunity to quickly get extra income. At least, that is what they hope to get.

But this type of income is usually accompanied by years of experience, hard-earned skills, and certain risks. Forex trading can never guarantee you profit. Besides, you need an initial deposit to get started as there is no way to start trading with zero investment.

Conditions for success

The main goal of every trader is to buy an asset as cheap as possible and to sell it as high as possible. Their entire activity is based on exchange rate fluctuations.

If quotes were not moving, speculation wouldn't be possible.

What do you need to be successful in the foreign exchange market? There are four main conditions that are crucial for every trader:

- Start-up capital. This is the money you need to buy a currency first with the aim of selling it later. If your initial deposit is increased by at least 5-10%, this is considered a good result. If you use the money you’ve earned to replenish your account, then you can have a profit of 200-400% of the initial deposit for the year;

- Knowledge and practice. These are acquired by practicing on a demo account, reading analytical reviews and on-topic articles;

- Calm attitude and enough time for trading. Sometimes, currency rates can change sharply by tens of pips over a very short period of time. These changes are not always in favor of a trader. If this happens, it is important to keep your emotions and greed under control;

- Cash safety cushion. Every forex trader must have one. If trading results in losses, you should have money to live a normal life.

Most efficient methods for forex trading

Professional traders agree that independent trading is the best available option. Along with this, there are some other ways to trade on Forex.

In the first case, you choose a broker which gives you access to Forex. You can’t access the market without an intermediary.

Traders make their own analysis, develop a trading plan, and open positions. Accordingly, in this approach traders manage their risks independently.

Among the advantages of this method are unlimited opportunities for gaining experience and extra income and complete freedom of action. At the same time, individual trading can be dangerous for beginners, especially at the very start.

Most surveys show that about 90% of newcomers lose their deposits when trading independently.

As we have mentioned above, there are more options to choose from.

For example, most brokers offer PAMM accounts which are useful tools for investing. Let’s see how they function.

Let’s say an experienced trader opens such an account and invests $10,000. He presents the Public Offer Agreement and invites other people to join.

The Public Offer Agreement contains the terms of this cooperation, including the distribution of profits and losses among all participants and penalties for backing out of the deal too early. Two beginning traders got interested in this offer, so they joined the PAMM account by investing $5,000 and $3,000 respectively.

The managing trader is performing transactions on this account in the course of the period specified in the Public Offer Agreement. After that, all participants get profit in accordance with their share in the PAMM account.

Yet, losses are also distributed between all of them.

A return of about 15% per month is considered normal.

Another way to trade Forex is to copy transactions of other traders. Naturally, we are talking about successful and experienced players.

This service is also offered by many brokers. Traders who offer their trades for copying get a commission for that.

Algorithmic trading with the help of expert advisors is another popular method. In this case, the process becomes fully automated and is controlled by a special trading program.

Depending on the current market situation, trading robots open and close positions. Traders don’t need to analyze indicators and monitor the process.

Note: with the previous two methods, a trader does not evolve as a professional and does not enhance his/her skills.

Betting, another trading method, is often compared to dealing with bookmakers. It allows players to get profit if they predict the direction of the price correctly.

In other words, traders bet on a rise or a fall in the price. If the price is moving according to the forecast, a trader wins.

This method is quite dangerous for beginners, especially if they are just trying to guess where the price will move next. Just like in basic trading, you need to have a proper forecast based on an in-depth analysis of the market.

Professionals agree that it is ok for novice traders to invest in PAMM accounts and use copy trading at the very start of their trading career. Yet, these two options will not help them develop their skills.

Therefore, independent trading, or classic trading in other words, is the only method that enables you to get valuable experience.

Strategies: Best way to trade Forex profitably

A strategy is a key component of successful FX trading. This is a plan that a trader follows.

The foreign exchange market has been functioning long enough. So, traders had time to recognize certain patterns and tendencies that formed the basis of strategies.

There are plenty of different strategies nowadays. So, opinions about them also differ.

Some traders think that the best strategies for gaining profit are scalping and intraday trading. Others believe that medium-term and long-term strategies are more profitable.

The same is true about using indicators. While there are a lot of advocates of indicator-based strategies, others prefer to trade without indicators and show good results.

While strategies are classified in many different ways, they all should meet the following criteria:

- Reasonable use: a strategy should be based on comprehensible market regularities such as trading with the trend, trading on pullbacks, and so on;

- Trading period: what time frames are used and how long trading lasts;

- Currency: a strategy may be suitable for one or several currency pairs;

- Analysis: if a strategy is based on technical analysis, it requires several main indicators and patterns. If it is based on fundamental analysis, specific news needs to be monitored;

- Entry and exit: what signals are used to open or close a trade and when Stop Loss and Take Profit are placed;

- Acceptable risks: what is the amount you can afford to lose in one trade and in different time periods.

So what are the most popular strategies among traders? We have prepared the top 5 most widely used strategies for you. Yet, you should keep in mind that the choice will depend on personal preferences, goals, and the financial state of a trader.

Best Forex strategies:

- The Ruler trading strategy is applied on the D1 time frame and is based on support and resistance levels. They serve as the main points for entering the market.

A trade should be opened at the moment when the price bounces off the lower level and the candlestick closes when the moving average stays at least above 10. A trade should be closed when the situation is the opposite.

If neither of the two variants is observed, a trader should stay out of the market and wait. The Price Action method is very similar to this strategy.

- The Parabolic trading strategy is used for М5-М15 time periods. The moving average is set to 25, while the settings of the Parabolic indicator should remain the same.

A close of the candlestick below the moving average and the location of the Parabolic above the price serves as a sell entry signal. A buy signal is formed when the technical picture is the opposite.

- Andrews’ Pitchfork strategy. The essence of this strategy is to spot the upper and lower reversal points that the so-called pitchfork will be based on. A trendline is a median line connecting the two reversal points.

A buy signal is formed when the price breaks above the upper descending line. A sell signal occurs when the price is moving below the lower ascending line.

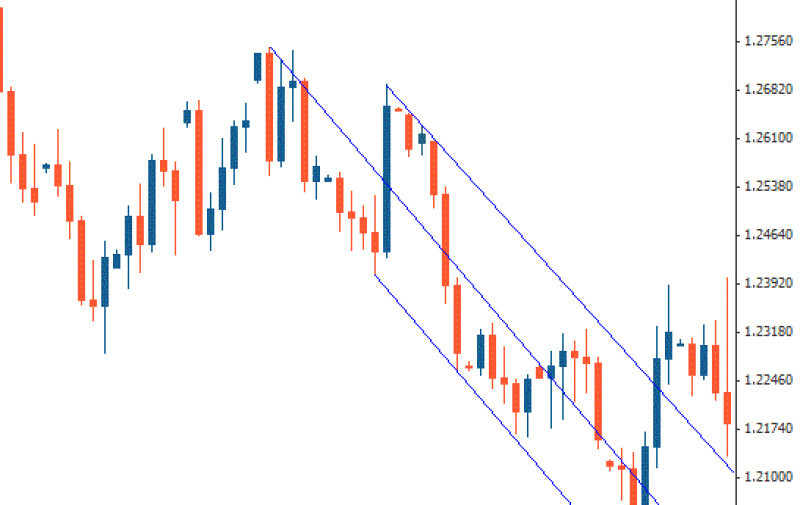

- Trend Lines. This trading method requires two time frames: H1 for analyzing the chart and M5 for opening trades.

This method based on trendlines is suitable for trading any currency pairs.

On the first chart, define two points on the trendline and then go to the second time frame. Wait for a rebound from the first point (which was second on H1) and proceed to the next high.

When the price heads for the trendline again, plot one more point. This will be the point for a pending order set 6-7 pips above the trendline.

So now we have three points on M5. Set a Stop Loss below the first one and a Take Profit near the second one.

Then act according to the market situation as shown on the chart below.

- 4-7 GMT is a breakout strategy applied mainly for GBP/USD on the M15 time frame. To determine the price range of an asset, or the so-called “box”, traders choose the time between 04.00 and 07.00 GMT to find the high and low of the price.

Buy and sell orders should be of the same volume and should be set 5 pips above and below the “box”.

All in all, there should be four pending orders: two buy-stop and two sell-stop orders. For the first order, a Take Profit should be set at 30 points and for the second order - at 60 points.

When the Take Profit is triggered on the first order, move the second one to breakeven.

Basic rules of FX trading

Choosing a suitable strategy and trying it out is still not a guarantee of success on Forex. One trading method would bring huge profits to some traders but would leave others at breakeven at best.

Why does it happen?

Trading, like any other things you do, is based on certain rules that need to be followed. This is what professional traders say.

Requirement №1: don’t get overexcited. A string of winning trades does not necessarily mean that this success will continue in the future.

Know how to stop in time and don’t put all your money at stake.

Requirement №2: stick to your strategy. Any spontaneous move in forex trading is a risk.

Requirement №3: estimate potential losses. When trading Forex, it is important to consider both profits and losses.

Do not use your entire deposit for a single trade. Close the trade immediately if the market turns against you.

Requirement №4: master your skills. Even experienced traders find the time for their professional development.

Remember: the sky's the limit.

Requirement №5: do not give up. Knowledge, experience, and suitable strategy can not guarantee that all your trades will be profitable.

In trading, you can not avoid losses. Just make sure that your profit amount exceeds that amount of losses.

Final thoughts

As you can see, the best way to trade Forex profitably can be hard and time consuming, and mere luck is not enough for consistent results. Choose a trading style and method that is most suitable for you. This way, your experience with the forex market will not resemble gambling.

Another useful tip from professional traders: stick to one strategy and do not waste your time and effort trying to follow various systems. As practice shows, this is not efficient.

Read more:

Back to articles

Back to articles